Author: John Mattiacci | Owner Mattiacci Law

Published January 25, 2026

Table of Contents

ToggleAfter a car accident in Pennsylvania, how much blame you share directly impacts whether you can get paid—and how much. The state follows what’s known as the 50 Percent Rule, a critical law that can shrink your settlement or even stop you from collecting a dime if you’re found mostly at fault.

What Is Pennsylvania’s 50 Percent Rule

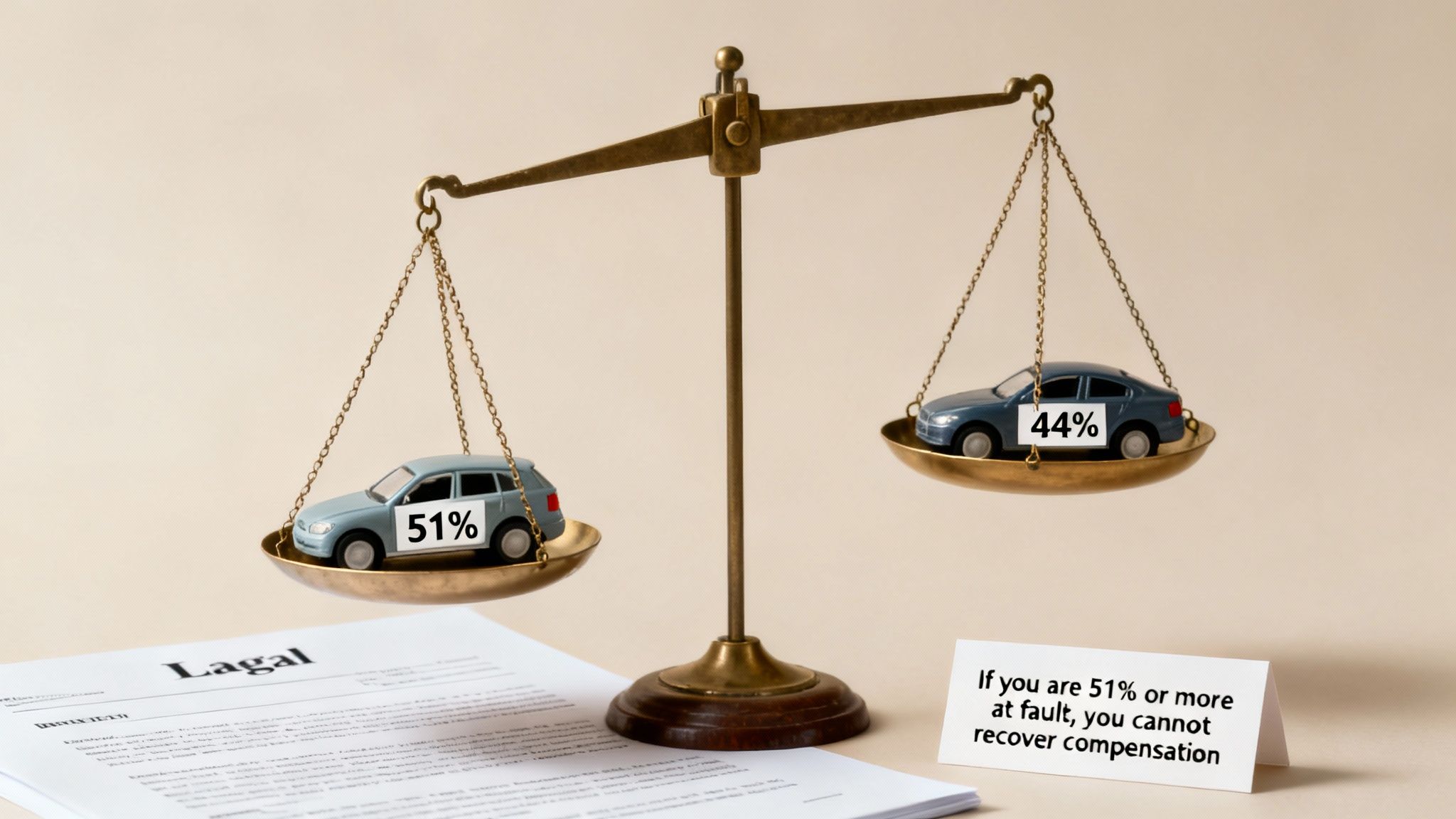

Think of a scale of blame after a crash. Pennsylvania’s 50 Percent Rule is the legal system for weighing that scale. The official name for it is “modified comparative negligence,” and it’s the bedrock of all personal injury claims here. It’s a system built on a simple reality: accidents are rarely 100% one person's fault.

This rule lets you recover money for your injuries as long as your share of the blame doesn’t go over 50%. The moment you’re found to be 51% or more at fault, you are completely shut out. No compensation for your injuries, medical bills, or lost paychecks. Zero.

The core principle is straightforward: If you are 51% or more at fault for an accident in Pennsylvania, you are barred from recovering any compensation.

This is exactly why insurance companies get to work so fast trying to shift blame onto you. Every single percentage point they can pin on you either slashes what they have to pay or wipes it out completely.

The Financial Impact of Shared Fault

The 50 Percent Rule creates a direct, mathematical link between your assigned fault and your final settlement check. Your total compensation gets reduced by your exact percentage of responsibility.

It's simple math. If a jury decides your case is worth $100,000 but finds you were 20% at fault, your award is cut by $20,000. You walk away with $80,000.

This rule comes into play constantly. In 2023 alone, Pennsylvania had 110,382 reportable traffic crashes that led to 66,563 injuries. For every single one of those incidents, the principles of modified comparative negligence were used to figure out who got paid and how much.

How Your Percentage of Fault Affects Your Compensation in PA

To see how this works in the real world, let's look at the financial consequences of the 50 Percent Rule on a hypothetical $100,000 claim.

| Your Percentage of Fault | Compensation You Can Recover | Why |

|---|---|---|

| 0% Fault | $100,000 | You are considered blameless and can recover the full amount of your damages. |

| 25% Fault | $75,000 | Your total compensation is reduced by your 25% share of the blame ($100,000 – $25,000). |

| 50% Fault | $50,000 | You are equally responsible, so your damages are cut in half ($100,000 – $50,000). |

| 51% Fault | $0 | Because your fault exceeds the 50% threshold, you are legally barred from recovering any money. |

As you can see, that 1% jump from 50% to 51% is the difference between getting half of your compensation and getting absolutely nothing.

This concept is the foundation of every negotiation with an insurance adjuster and every argument made in a courtroom. You can learn more about what happens if both drivers are at fault in Pennsylvania in our detailed guide.

How Fault Is Determined in a Pennsylvania Car Accident

Figuring out who’s at fault after a car accident isn't just a guessing game. It’s a meticulous investigation, where every piece of evidence helps build a clear picture of what happened and who was negligent. Think of it like assembling a puzzle. Investigators, insurance adjusters, and attorneys piece everything together to reconstruct the crash and assign a percentage of blame to each driver.

This process is absolutely critical. Since your ability to get paid hinges on being 50% or less at fault, the evidence gathered will make or break your case. Even one small detail can shift the percentages, deciding whether you get a fair settlement or walk away with nothing.

The Building Blocks of a Fault Investigation

The first few hours and days after a crash are the most important for collecting the evidence that will become the foundation of your claim. The focus is always on objective, factual information that establishes a timeline and shows who broke a traffic law or simply wasn't paying attention.

Several key pieces of evidence are almost always at the center of this process:

- The Official Police Report: This is usually the first and most important document. It includes the officer’s on-scene observations, statements from drivers and witnesses, a diagram of the crash site, and any traffic tickets they issued. A citation for speeding or running a red light is a powerful starting point for proving fault.

- Witness Testimonies: An independent witness who saw the whole thing can be a game-changer. Their unbiased account can back up your story or poke holes in the other driver's, making their testimony incredibly valuable.

- Photographs and Video Footage: In today’s world, a picture really is worth a thousand words. Photos of the vehicle damage, skid marks on the road, traffic signals, and road conditions tell a story that words can't. Even better, dashcam footage or video from a nearby business can offer indisputable proof of how the collision went down.

Deeper Analysis with Expert and Technical Evidence

For more complicated accidents—especially crashes involving serious injuries or where drivers are telling two different stories—the investigation has to go much deeper. This is where we bring in the technical data and expert analysis to provide a scientific breakdown of what happened.

An accident reconstruction expert can use physics, engineering, and forensic analysis to recreate the collision. They analyze vehicle crush damage, roadway evidence, and computer data to calculate speeds, impact angles, and driver actions with a high degree of accuracy.

These experts often pull data from a vehicle’s Event Data Recorder (EDR), which most people know as the "black box." An EDR captures a snapshot of critical information in the seconds right before a crash.

What a vehicle’s EDR can reveal:

- Vehicle Speed: It shows exactly how fast each car was going just before impact.

- Brake Application: It records if the brakes were slammed on and how hard.

- Steering Input: It can track the angle of the steering wheel.

- Seatbelt Use: It confirms if the driver and passengers were buckled up.

This data gives you a second-by-second digital replay of a driver's actions, making it extremely hard for someone who was at fault to deny what they did.

Applying Evidence to Common Philadelphia Accidents

Let's think about a common headache in Philly: a chain-reaction collision on I-95 during rush hour. Most people assume the driver who started the rear-end pile-up is automatically at fault. But what if an accident reconstruction expert pulls EDR data showing the driver in the middle was tailgating and never even hit the brakes? In that case, fault could be shared.

Or take a T-bone crash at a busy intersection like Broad and Vine. Traffic camera footage becomes the star witness. It can definitively prove which driver had the green light, clearing up the question of liability in an instant.

Ultimately, every piece of evidence works together to assign that all-important percentage of fault. A strong collection of proof is your best defense against an insurance company’s attempt to push your share of the blame over the 50% line. Understanding the details of Pennsylvania's comparative negligence law is essential for protecting your claim.

The 50 Percent Rule in Real-World Scenarios

Theory is one thing, but seeing how Pennsylvania’s 50 Percent Rule plays out with real numbers makes the financial stakes hit home. The math itself isn't complicated, but the consequences can be huge.

Let's walk through a few common situations to see exactly how a percentage of fault can completely change the outcome of a car accident claim. These stories show why every single detail matters when an insurance company or a jury starts figuring out who was to blame.

Scenario 1: The Minor Mistake with a Major Cost

Picture this: Sarah is driving through a busy Philadelphia intersection with a green light. Out of nowhere, another driver blows through a red light and T-bones her car. Sarah ends up with a broken arm and whiplash, leading to $100,000 in damages from medical bills, lost work, and her pain and suffering.

But during the investigation, a traffic camera shows something else. While the other driver was clearly wrong for running the light, Sarah had rolled a few feet past the white stop line while waiting for it to turn green. The insurance adjuster latches onto this, arguing it contributed to the crash.

- Total Damages: $100,000

- Fault Assigned to Sarah: 10%

- Calculation: $100,000 – (10% of $100,000) = $90,000

- Final Outcome: Sarah can still get a settlement, but that small mistake shaves $10,000 right off the top.

Scenario 2: Sharing Significant Blame

Now, let's look at David, a motorcyclist on the Schuylkill Expressway. He’s lane-splitting between slow-moving cars—which is illegal—when an SUV driver, glued to their phone, changes lanes without a signal and sideswipes him. David is seriously hurt, with total damages adding up to $250,000.

In this case, both people made serious mistakes. The SUV driver was negligent for being distracted and not signaling. But David's choice to lane-split also broke traffic laws and put him in a very dangerous spot.

- Total Damages: $250,000

- Fault Assigned to David: 40%

- Calculation: $250,000 – (40% of $250,000) = $150,000

- Final Outcome: Since David is less than 51% at fault, he can still recover money. However, his large share of the blame slashes his final compensation by a massive $100,000.

This infographic breaks down the kind of evidence lawyers and insurance companies use to assign these critical fault percentages.

It’s the combination of police reports, video evidence, and what witnesses saw that paints the full picture for investigators.

Scenario 3: Crossing the Line and Losing Everything

Our last example involves Michael, who is running late. Stuck in traffic on a one-way street, he decides to pull an illegal U-turn to find a faster route. As he swings his car around, an oncoming delivery truck that was speeding slams into him. The crash is bad, and Michael's damages are a staggering $500,000.

A jury has to decide whose negligence was the main reason for the crash. While the truck was speeding, Michael's illegal and totally unexpected U-turn created the immediate danger that led to the collision.

After hearing all the evidence, the jury finds the truck driver was 49% responsible for speeding. But they place the majority of the blame—51%—on Michael for his reckless U-turn.

- Total Damages: $500,000

- Fault Assigned to Michael: 51%

- Calculation: Because Michael's fault is over the 50% line, the calculation just stops.

- Final Outcome: Michael gets $0. That one single percentage point is the difference between getting a fair settlement and walking away with absolutely nothing to show for half a million dollars in damages.

As you can see, Pennsylvania’s 50 Percent Rule isn't just a legal technicality. It has a direct and powerful impact on your case. A tiny bit of fault lowers your award, a bigger share takes a huge bite out of it, and being even slightly more than half to blame means you get nothing at all.

How Insurance Companies Use the 50 Percent Rule Against You

After a car accident, the other driver’s insurance adjuster might call you and sound genuinely concerned. They can seem friendly, helpful, and eager to get things sorted out. But it's critical to remember they are not on your side. Their one and only job is to protect their company's profits, and Pennsylvania’s 50 Percent Rule is one of the most effective tools they have to do it.

An adjuster’s goal is brutally simple: shift as much of the blame as possible onto you. Every single percentage point of fault they can pin on you directly lowers the amount they have to pay. And if they can successfully push your share of the blame to 51%, their company gets to walk away paying you nothing at all. This financial motive is the driving force behind their entire strategy, starting from the very first phone call.

Common Tactics Adjusters Use to Assign Fault

Insurance companies have this down to a science. They train their adjusters to investigate claims in a way that serves their financial interests, not yours. They will pick apart every detail of the accident, hunting for any scrap of information they can use to argue you were partially—or mostly—to blame.

Here are a few of the most common tactics they pull from their playbook:

- Using a Recorded Statement Against You: An adjuster will almost always ask for a recorded statement, often just hours after the crash when you're still shaken up. They'll ask leading or confusing questions designed to box you into a corner or get you to admit fault without even realizing it. Saying something as simple and polite as “I’m so sorry this happened” can be twisted and used against you later as an admission of guilt.

- Misinterpreting the Evidence: They are masters at focusing on tiny, irrelevant details to inflate your percentage of blame. For instance, they might argue you were driving just one or two miles over the speed limit, even if the other driver blew through a stop sign at 30 mph. Their goal is to build a narrative where you share the blame, no matter how negligent the other driver was.

- Pressuring You Into a Quick, Lowball Settlement: This is one of their go-to moves. They'll offer you a fast, low settlement before you even know the full extent of your injuries or understand your legal rights. This first offer is almost always based on an unfair assignment of fault and is designed to make your claim go away for pennies on the dollar.

The insurance company's first offer is almost never their best one. It's a calculated lowball, representing the smallest amount they think you might accept—often before you've even had a chance to speak with an attorney.

This is exactly why you have to be so careful. Anything you say or do can be used to build a case against your own claim.

Why You Should Never Admit Fault

In the chaotic moments after a collision, it's completely normal to feel confused, overwhelmed, or even apologetic. But you have to resist the urge to admit any fault—not to the other driver, not to the police, and especially not to an insurance adjuster. You simply don’t have all the facts about what really caused the crash, and any admission can seriously torpedo your ability to get fair compensation.

Even an off-the-cuff comment can be documented and thrown back at you later to argue that you accepted responsibility for the accident. If you find yourself in a situation where the insurance company says you are at fault when you are not, having a clean record with no admissions of fault is your single strongest defense.

The smartest strategy is to stick to the facts of what you saw and experienced, without guessing or speculating about who was to blame. Let the evidence—like the police report, photos from the scene, and witness statements—do the talking. Speaking with an experienced car accident attorney before giving any formal statements is the best way to level the playing field and protect your claim from these aggressive tactics.

Protecting Your Claim After a Car Accident

The moments after a car accident are a blur of chaos and stress. But what you do right then and there can completely change the outcome of your claim. With Pennsylvania’s 50 Percent Rule hanging over every single case, protecting your rights starts the second the crash happens.

Think of it this way: every piece of evidence you gather is another brick in the wall you're building to defend your claim. Insurance adjusters are trained to find ways to shift blame onto you, and a strong wall of facts is your best defense. This isn't about being confrontational; it's about preserving the truth before it gets twisted or forgotten.

Your Immediate Post-Accident Checklist

To protect your claim, you have to be methodical. Your health and safety come first, obviously, but these next steps are absolutely critical for locking down the facts and guarding your legal rights.

If you are physically able to, here’s an actionable checklist to run through:

- Get Safe and Call 911: The first move is to get to a safe spot, if possible. Then, call 911. This is non-negotiable. It gets medical help on the way and, just as importantly, brings law enforcement to create an official police report—a cornerstone document for any future claim.

- Document Everything with Your Phone: Your smartphone is the most powerful tool you have at the scene. Take photos and videos of everything from every angle. Capture vehicle positions, property damage, skid marks, road debris, and any relevant traffic signs or signals. You can't have too many pictures.

- Gather Witness Information: Independent witnesses are gold. If anyone saw what happened, politely ask for their name and phone number. Their unbiased story can shut down the other driver’s version of events and provide crucial context.

- Exchange Information Carefully: Swap only the essential info with the other driver: name, address, phone number, and insurance details. That’s it. Do not discuss how the accident happened. Do not apologize. Even a simple "I'm sorry" can be twisted into an admission of fault later on.

The Critical Role of Medical Attention

Seeing a doctor right away is one of the most important things you can do—both for your health and your claim. You might feel fine, but adrenaline can mask serious injuries like whiplash or concussions that show up hours or days later.

Going to an urgent care center or your own doctor immediately creates an official medical record. This record directly links your injuries to the accident, which makes it much, much harder for an insurance company to argue your injuries were pre-existing or happened somewhere else.

A documented medical evaluation is powerful proof. It establishes a clear timeline of your injuries, which is vital for proving the full extent of your damages and fighting back against claims that you weren't seriously hurt.

Understanding Your Insurance Choices

Finally, your own insurance policy plays a huge part in all of this. In Pennsylvania, drivers choose between Full Tort and Limited Tort coverage. This single choice directly impacts your right to sue for non-economic damages like pain and suffering.

- Full Tort: Gives you the unrestricted right to sue the at-fault driver for all your damages, including pain and suffering.

- Limited Tort: Restricts your ability to recover pain and suffering damages unless your injuries meet the legal definition of "serious."

Choosing Full Tort gives you the strongest possible foundation for a claim and much more leverage. A jury will review all the evidence to assign fault, and even a tiny detail can make a massive difference. For instance, if a driver was slightly distracted and found 10% at fault for a crash valued at $200,000, they can still collect $180,000.

But if an insurer can prove that same driver was texting and pins 51% of the fault on them, that recovery drops to zero. With 66,563 injuries in Pennsylvania in 2023, countless victims find that having the right evidence and the right coverage is what turns a statistic into fair compensation. For a deeper dive into these nuances, you can learn how fault impacts insurance claims in Pennsylvania.

Common Questions About PA Car Accident Fault Rules

After a car accident, your head is probably spinning with questions about fault, insurance, and paying your bills. Pennsylvania's 50 Percent Rule can feel a bit confusing at first, but figuring out how it works is the key to protecting your right to compensation.

Let's break down some of the most common questions we get from clients every day.

What Happens If More Than One Person Caused My Accident?

It’s rare for a crash to be simple, and a lot of the time, more than one person shares the blame. When a few different drivers contribute to a collision, Pennsylvania law uses the Fair Share Act to sort things out. This law is designed to divide up the responsibility among all the at-fault parties based on their percentage of fault.

Think about a three-car pile-up where one driver was texting and another was tailgating. A jury would look at all the evidence and assign a percentage of blame to each of them. You could then recover a piece of your damages from one driver and the rest from the other, matching their share of the fault.

But there's a huge exception to this, and it's called joint and several liability.

In Pennsylvania, if one person is found to be 60% or more at fault for the accident, they can be forced to pay for the entire verdict, no matter who else was partially to blame.

This is a big deal for injured victims. It means you can get your full compensation from the one person who was overwhelmingly negligent. That person can then go after the other at-fault drivers to get reimbursed. It protects you from getting short-changed just because one of the responsible drivers has no insurance or assets.

Can I Still Get Compensation If I Know I Was Partly At Fault?

Yes, absolutely. This is one of the biggest misconceptions out there, and it stops a lot of people from even trying to file a claim. Being partially to blame for a crash does not automatically mean you get nothing. Insurance companies love when you think that, but it's just not true.

The whole point of modified comparative negligence is to deal with the reality that accidents are messy and fault is often shared. The law gives you a clear path to get paid as long as you meet one simple condition: your share of the blame can't be more than the other guy's.

Here's the bottom line:

- If you are found to be 50% or less at fault, you can still recover money.

- Your final payout will just be reduced by your percentage of fault.

- But if your fault is 51% or more, you get nothing. The door slams shut.

This is exactly why you need a real investigation into what happened. An insurance adjuster will jump at any chance to pin more blame on you. They might say that because you were going five miles over the speed limit, the crash was mostly your fault. But a good lawyer and an accident reconstruction expert could prove the other driver running a red light was the real cause.

Never just assume your partial fault means your case is over.

How Long Do I Have to File a Car Accident Lawsuit in Pennsylvania?

Pennsylvania has a strict deadline for filing a personal injury lawsuit, and it’s known as the statute of limitations. For car accidents, this is a date you absolutely cannot miss.

You have two years from the date of the accident to file a lawsuit.

Two years might sound like a long time, but in the legal world, it flies by. Building a strong case isn't just about filling out some forms; it takes a ton of work on the front end.

Before that two-year clock runs out, your legal team needs to:

- Investigate Everything: Gather police reports, track down witnesses, get your medical records, and find any surveillance video that might exist.

- Bring in Experts: In many cases, we need to hire accident reconstruction specialists or medical experts to analyze the evidence and give a professional opinion.

- Calculate Your Damages: We have to figure out the total cost of your injuries—not just the bills you have now, but future medical care, lost earning ability, and your pain and suffering.

- Negotiate with the Insurer: Most cases start with back-and-forth negotiations with the insurance company, which can take months on its own.

If you wait until you're close to the deadline, you risk losing your right to compensation forever. Once that statute of limitations expires, the court will throw your case out, no matter how badly you were injured. Acting fast gives your lawyer the time they need to build the strongest case possible for you.

If you've been injured in a car accident, understanding your rights under Pennsylvania's fault rules is the first step toward getting the compensation you deserve. The experienced attorneys at Mattiacci Law are here to guide you through every step of the process. We conduct meticulous investigations and fight to ensure fault is assigned fairly, protecting you from the tactics insurance companies use to deny your claim. For a free, no-obligation consultation to discuss your case, contact us today at https://jminjurylawyer.com.